Nothing says summer like sitting on the bow of a boat and sunbathing, especially on the California coast. But before you hit the open ocean, take a moment to get a watercraft insurance quote. Watercraft, like a lot of luxury items, require a significant up-front investment followed by regular upkeep. You have to winterize it at the end of the season, and get it maintained before you put it in the water. With everything you put into keeping your boat in the water, it’s critical to insure it, too. At Freeway Insurance, we’ve outlined why it’s so important for you to get watercraft insurance this summer. Read on to learn more about what to consider when you’re looking at watercraft insurance coverage and how you find great watercraft insurance quotes online.

What to Consider When You’re Shopping for Watercraft Insurance

Boating Magazine suggests that there are only two ways to get the best boating insurance. First, get a great underwriter. Second, choose an experienced insurance agent. Instead of focusing on how much watercraft insurance will cost you, focus on your coverage. If you end up losing your boat, you’ll wish you had paid a higher monthly premium than funding the cost of reclamation. You’ve already put a lot of money into your watercraft, and it’s worth it to spend a little more to protect your investment.

Still, watercraft insurance isn’t for everyone. For example, if the total of your 12 monthly premiums equals or exceeds the cost of your watercraft, you might want to reconsider whether you need boating insurance.

Whereas watercraft insurance might not always be necessary, liability insurance is for everyone. Lakes, oceans, and rivers are unpredictable environments. Add boaters with a variety of experience and ability levels, and you’re encountering risk potential every time you drive out onto the water. Should you get into an accident, liability insurance protects you from financial ruin. Depending on the damage and other factors, your liability insurance can help you pay for medical bills, property damage, and boat repairs.

Your boating insurance quote will depend on four main factors: who will drive the watercraft, what the watercraft’s estimate value is, what its size and model is, and where and how the watercraft is used. For example, a seafaring boat will have different insurance costs than a lake-bound watercraft.

How to Get an Affordable Watercraft Insurance Quote

Before you purchase watercraft insurance, verify your insurance company’s consumer rating. You’ll want to make sure you’ll be getting exactly the kind of coverage you’ve paid for, and that you’ll be dealing with insurance experts. Boat accidents, related medical bills, and the potential liability can be very expensive. It’s imperative that you have reliable coverage in the event of an accident.

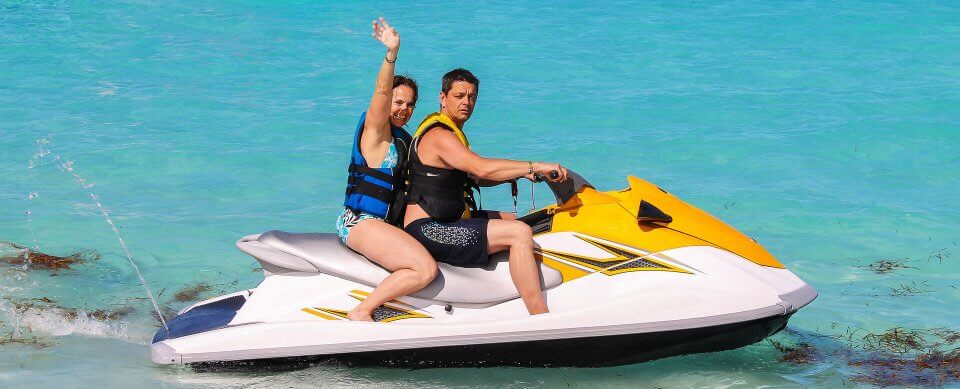

Freeway Insurance offers watercraft insurance with a wide range of additional coverage options, including winter storage, open ocean, freshwater boat, and accessories coverage. We also can insure personal watercraft, such as jet skis.

Get a watercraft insurance quote online from Freeway Insurance today. You can also give us a call at 800-777-5620 to receive your free quote. We’re available to answer any questions you may have about watercraft insurance.